Paynow Corporate is a new payment method launched to help businesses and SMEs. You have probably heard all the buzz about it.

In this article, we’ll share with you in depth about this new cashless payment method in Singapore and why you , as a business owner, should adopt it for your business.

Launched in 27th June 2017, Singapore’s push to become a smart nation gave birth to the cashless peer to peer (P2P) payment method PayNow. As of 10th August 2018, PayNow amassed a record transaction amount of 1.2 billion dollars. PayNow’s popularity later was overwhelming and PayNow Corporate was subsequently launched for businesses as an e-payment service.

Learn about what it is and how you can hop on the new service now:

What is Paynow?

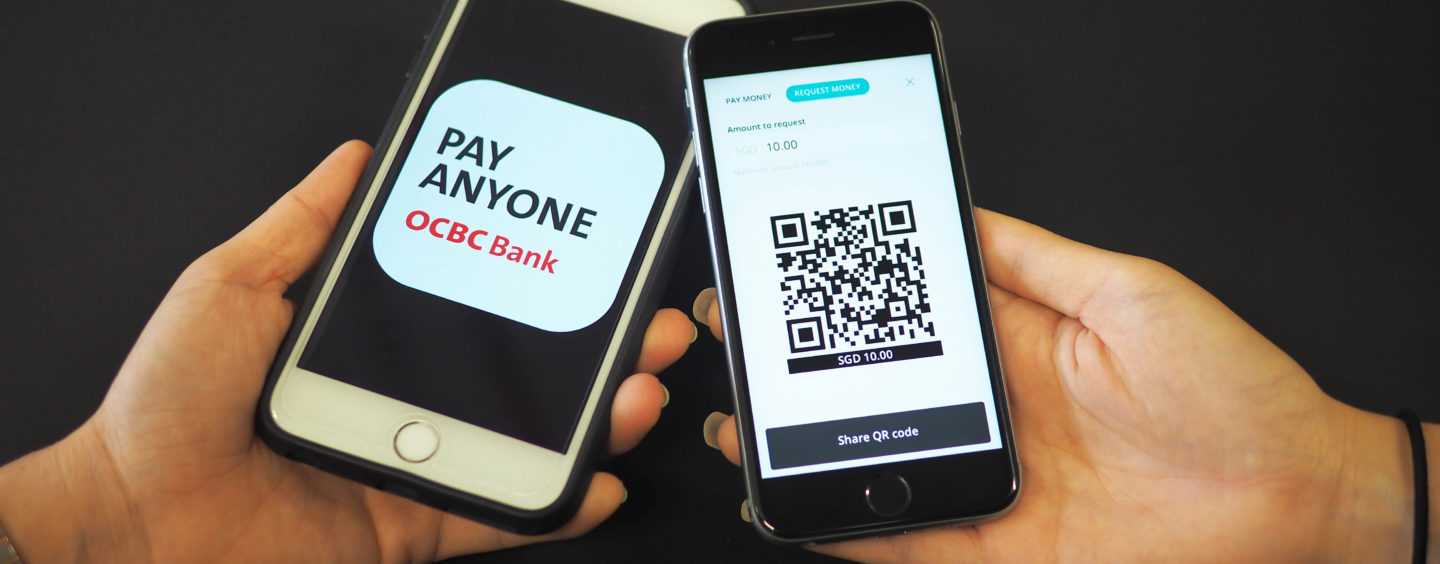

Paynow is a convenient and efficient fund transfer system created by the Association of Banks in Singapore (ABS) in response to demand for simpler forms of transfers.

With Paynow, you only need to know the mobile phone number or Singapore NRIC number of a recipient to send funds to them. Long gone are the days where you have to know another person’s bank and account number to transfer money!

What is Paynow Corporate?

On 13th August, the service was expanded to include businesses as well.

This new system of payment will allow companies to send and receive funds through FAST using their company’s Unique Entity Number (UEN).

Why should my business use Paynow Corporate?

Convenience: There is no need to send your bank account details or business details in order to make transfers. Make transfers using UEN/NRIC or mobile numbers!

Seamlessness: Receive payment from customers simply by using your UEN or even QR code. Hassle-free and simpler for all parties involved.

Is it safe?

Paynow is highly secure and it is backed by both the Singapore Government and The Association of Banks in Singapore. Also, Paynow adopts the high standards of security established for local fund transfers.

Is there a limit to the amount I can transfer?

Yes, but its much higher than you think. For FAST transfers, the limit is $200,000. If you require to send more, you can use GIRO, which has no limits!

Are there charges to register?

Online registration for PayNow Corporate is absolutely free for all businesses with an existing banking account.

We have done a quick survey for the 3 local banks and they do not have any registration charges for PayNow Corporate if you register for the service online.

It is worthy to note that UOB charges a $10 set up fee for manual form applications, which will be waived from now till 31 December 2018, probably to help its less tech-savvy customers to adopt the new service.

Will there be charges for making a payment through PayNow?

[Updated August 2019]

| Incoming | Outgoing | |

| UOB | FAST – Waived until 31st December 2019, $0.20 thereafter GIRO – Waived | FAST – $0.50 per item till 30st Sep 2019, $0.70 thereafter GIRO – $0.40 per item |

| OCBC | After 31st Dec 2019, $0.20 charge for searching for companies using UEN number FAST – Waived until 31st Dec 2019 GIRO – Waived until 41st Dec 2019 | From July 2019, $0.20 charge for searching for companies using UEN number FAST – $0.50 per item GIRO – $0.20 per item |

| DBS | All fees waived till 31st Dec 2019 | FAST — S$0.50 per transaction till 31st Dec 2019, $0.70 thereafter GIRO —$0.20 per transaction $0.20 charge for searching for companies using UEN number |

| Maybank | All fees waived till 31st Dec 2019 | All fees waived till 31st Dec 2019 |

| Citibank | $0.50 per transaction* *Preferential pricing available | $0.50 per transaction *Preferential pricing available |

| Standard Chartered | All fees waived | FAST – Waived for first 30 transactions ($1 per transaction thereafter) GIRO – $1 per transaction |

| HSBC | FAST – $1 per per transaction | FAST — S$1.00 per transaction GIRO – $-0.50 per transaction |

| Bank of China | All fees waived till 31st Dec 2019 | All fees waived till 31st Dec 2019 |

Do check back here for updates, you may wish to bookmark this page for further reference!

How do I pay with Paynow Corporate?

Don’t fret! It’s really really simple. So simple, in fact, you can understand it by just watching these two helpful videos made by The Association of Banks in Singapore (they’re the guys who created the whole system!):

How to Receive Money Using Paynow

How to Send Money Using Paynow

Essentially, it’s the same as a regular Paynow transaction, but only with a company with a UEN number.

If you prefer, you could also get a Paynow QR from your bank of choice so that your customers have the option of paying by scanning a QR code. Here’s another video to show you how that process works:

Eezee is proud to be a early adopter of Paynow QR on our website too, join us and give your customers more payment options today.

So you’re ready to jump in!

Currently, the PayNow Corporate Payment Method is only available if your business is registered with one of these 7 banks. Click on the bank that you’re registered with and it’ll take you to their registration page, complete with all the steps you need to take to start your Paynow journey!

UOB

Register to use the service from this form.

Also, you may also register instantly for Paynow using BIBPlus.

OCBC

You can apply for the service using your OCBC Mobile Banking App OR register via Velocity@ocbc.

DBS/POSB

Apply via DBS IDEAL (mobile app) OR manual form submission.

Citibank

Details to be confirmed!

Maybank

Complete their registration form and submit via email to paynow@maybank.com.sg. AND apply for Business Internet Banking (BIB) with Funds Transfer.

Standard Chartered

Fill up their registration form and submit via email to Service.SGBizBanking@sc.com.

HSBC

Register for an account on HSBCnet.

Bank of China

You can register for PayNow Corporate with BOC via BOC Corporate Online Banking. During registration, you will need to:

- Select the relevant BOC Singapore dollar corporate account to link to PayNow Corporate

- Select the relevant Corporate Proxy to be used (e.g. UEN / UEN with Suffix)

If you do not have BOC Corporate Online Banking, you may apply for this service by contacting your relationship manager or downloading the application form from the BOC (Singapore) website at http://www.bankofchina.com/sg/cn/.

![Paynow Corporate Guide: What You Should Know [Updated 2019]](https://eezee.sg/blog/wp-content/uploads/2018/11/Artboard-1@2x.png)

Stay connected